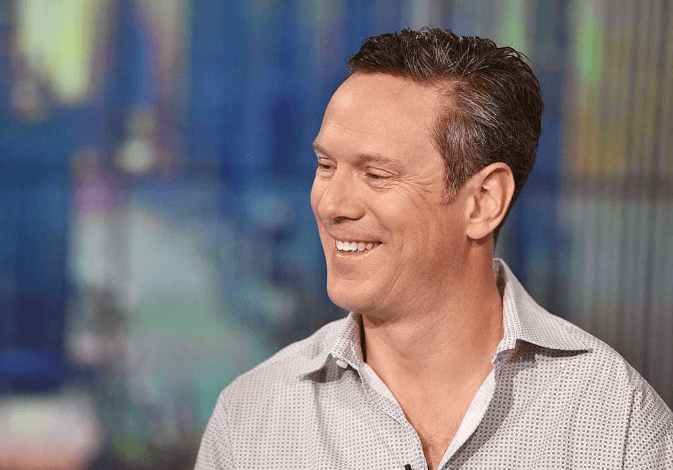

Drew Bledsoe Net Worth: The NFL Legend’s Finances

Drew Bledsoe, renowned for his remarkable tenure in the NFL, has amassed an estimated net worth of $48 million by 2023, reflecting not only his prowess on the field but also his astute financial acumen. From commanding contracts during his playing days to successful business ventures, including a thriving wine enterprise, Bledsoe’s financial journey is multifaceted. His strategic investments and philanthropic initiatives further underscore a thoughtful approach to wealth management. What specific strategies contributed to his financial success, and how do they compare to those of other NFL legends?

Early Career Earnings

Drew Bledsoe’s early career earnings were significantly influenced by his selection as the first overall pick in the 1993 NFL Draft, which led to a lucrative contract with the New England Patriots that established the foundation for his subsequent financial success.

His rookie contract not only solidified his role within the team dynamics but also set a precedent for future quarterbacks entering the league.

Major Contracts Overview

Bledsoe’s financial trajectory was further shaped by a series of major contracts throughout his NFL career, reflecting both his value as a starting quarterback and the evolving landscape of player salaries in professional football.

His contract negotiations often navigated the complexities of the salary cap, allowing him to secure lucrative deals that positioned him among the highest-paid players of his era.

Endorsement Deals

Endorsement deals played a significant role in enhancing the financial portfolio of the former quarterback, contributing substantially to his overall net worth beyond his earnings from the NFL.

Bledsoe’s endorsement history reflects strategic brand partnerships that included:

- Sports apparel brands

- Beverage companies

- Automotive firms

These collaborations not only amplified his visibility but also established a lucrative revenue stream, further solidifying his financial legacy.

Business Ventures

In addition to his successful endorsement deals, Bledsoe has pursued various business ventures that have significantly contributed to his net worth, showcasing his entrepreneurial spirit and ability to leverage his fame in the sports industry.

His wine business has gained recognition for its quality, while his coaching academy aims to develop young talent, reflecting Bledsoe’s commitment to fostering growth within sports and business.

Real Estate Investments

Drew Bledsoe’s real estate investments reflect a strategic approach to wealth management and asset diversification.

His notable property acquisitions highlight a keen understanding of market dynamics, while an overview of his investment strategies reveals a calculated methodology aimed at maximizing returns.

An analysis of current market trends further contextualizes Bledsoe’s real estate portfolio within the broader economic landscape.

Notable Property Acquisitions

Bledsoe’s strategic real estate investments reflect a keen understanding of market dynamics and a commitment to building long-term wealth beyond his football career.

His notable property acquisitions include:

- A luxurious home in Washington state.

- Several vacation properties in desirable locations.

- Investment in commercial real estate, diversifying his portfolio.

These ventures illustrate his foresight and dedication to financial independence.

Investment Strategies Overview

The strategic approach to real estate investments employed by Bledsoe reflects a comprehensive understanding of market trends and risk management, allowing for a diversified portfolio that maximizes potential returns while minimizing exposure to volatility.

His focus on sustainable investing incorporates rigorous risk assessment methodologies, ensuring that each investment aligns with both financial goals and ethical considerations, ultimately fostering long-term wealth and stability.

Market Trends Analysis

Analyzing current market trends in real estate investments reveals a dynamic landscape characterized by fluctuating interest rates, evolving buyer preferences, and increasing demand for sustainable properties.

The economic impact of these market fluctuations can be observed through:

- Rising property values in eco-friendly developments.

- Increased investment in urban properties.

- Shifts towards remote working influencing suburban demand.

These factors shape an evolving investment strategy.

Philanthropic Efforts

Throughout his career and beyond, Drew Bledsoe has demonstrated a strong commitment to philanthropy, engaging in various initiatives that focus on education, health, and community development.

His charitable initiatives include supporting youth programs and health awareness campaigns, reflecting a dedication to enhancing community outreach.

Bledsoe’s efforts exemplify how athletes can leverage their influence to foster positive change and empower future generations.

Financial Management Strategies

Effective financial management strategies are crucial for sustaining and growing wealth, as exemplified by Drew Bledsoe’s approach.

Central to his financial planning are investment diversification and meticulous budgeting for retirement, both of which mitigate risk and ensure long-term financial stability.

Investment Diversification Approach

A well-structured investment diversification approach is essential for minimizing risk while optimizing potential returns in a financial management strategy.

Understanding the diversification benefits can enhance risk management through:

- Asset Allocation: Spreading investments across various asset classes.

- Sector Diversification: Investing in different industries to mitigate sector-specific risks.

- Geographical Diversification: Including international investments to reduce country-specific vulnerabilities.

Such strategies empower investors to achieve financial freedom.

Budgeting for Retirement Planning

Budgeting for retirement planning is a critical component of financial management that involves strategically allocating resources to ensure a secure and comfortable post-working life.

Establishing a clear understanding of retirement income sources is essential for aligning expenditures with financial goals.

Current Net Worth Estimate

As of 2023, Drew Bledsoe’s net worth is estimated to be approximately $48 million, reflecting his successful career as an NFL quarterback and subsequent ventures in business and wine production.

His current financial status demonstrates effective wealth accumulation through:

- NFL contracts and endorsements

- Business investments, particularly in the wine industry

- Strategic financial management and planning

These factors contribute to his enduring financial success.

Conclusion

In conclusion, Drew Bledsoe’s financial journey mirrors the arc of a compelling narrative, marked by triumph and resilience.

From the heights of NFL stardom to the nuanced landscapes of business and philanthropy, Bledsoe exemplifies the ability to transcend the limitations of a singular career.

The strategic investments and philanthropic commitments not only reflect astute financial acumen but also resonate with a legacy that extends beyond the gridiron.

Ultimately, this journey inspires future generations to navigate their own paths to success.